The Story of WallStreetBets, GameStop and Robinhood

February 3, 2021

What is WallStreetBets?

The Reddit group, WSB (WallStreetBets) is a subreddit where participants discuss stock and option trading. Users are generally regular people who are trading and speculating but they’ve occasionally found and exploited key weaknesses in Wall Street or in financial products (such as a large number of hedge funds betting that certain stocks will go down, etc.). As of this week, it had around 2.9 million users and 726,000 were viewing the forum. The majority of the users on WSB purchase options instead of stocks. Purchasing a stock gives you a direct portion of a company (when you have a stock, you literally own a piece of the company). An option is a contract you can buy that lets you buy or sell a stock at a certain price in the future, meaning you only own the contract, not the stock itself. For example, you pay a small price for the right to buy a share of a stock like GameStop for an agreed price at some date in the future. The catch of buying an option is that each contract is for 100 shares of a company at a set price, and if you bet wrong, you can be stuck with a literally worthless asset. As the expiration date of the contract draws closer, the valuation of the contract can swing rapidly, as it will become worthless to the buyer if it doesn’t hit its target price. For speculators who think a stock might rise, it’s a way to get a far greater profit than simply buying the stock.

GameStop

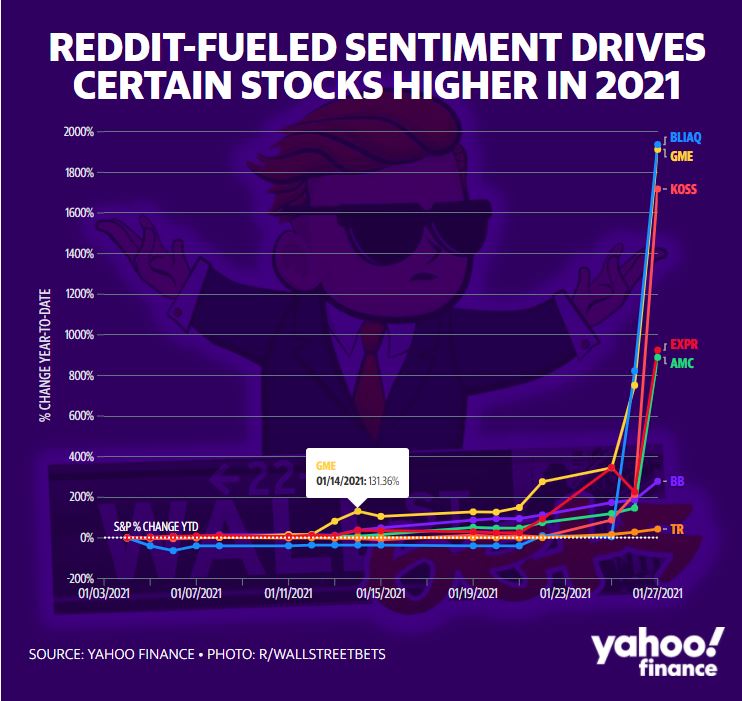

GameStop is a video game retailer that operates out of brick and mortar stores, which have been struggling given the pandemic. WSB and GameStop converge last September. One of the two catalysts behind the rise of GameStop stock was Ryan Cohen – investor and founder of the online pet food giant, Chewy. Cohen took a 13% stake in GameStop and started lobbying for it to move more of its business online and become a serious rival to Amazon. Cohen and two associates were added to the company’s board in January. GameStop’s share price began to soar as small investors invested in this cheap stock. The second catalyst was that retail investors posting on WSB were broadcasting their intentions to take down a prominent hedge fund, Melvin Capital. They would do so by buying call options on GameStop, a stock in which Melvin had disclosed a big short bet (shorting a stock is when you bet against a company and believe that the stock price will go down). WSB Reddit users were able to discover Melvin Capital’s short against GameStop because it was expressed in their SEC (Securities Exchange Commission) disclosure. Bets that hedge funds make must be disclosed in filings with the SEC.

Why did WallStreet bets want to go up against big hedge funds?

GameStop won't stop

GameStop has been the most actively traded stock by customers of Fidelity Investments and volatility prompted the New York stock exchange to briefly halt trading nine times. Wall Street Bets subreddit group ended up going private for a little less than an hour on Wednesday evening. During the time the subreddit was private, there were a few different messages shown to visitors. One of them was, “We are experiencing technical difficulties based on an unprecedented scale because of the newfound interest in WSB. We are unable to ensure Reddit’s content policy and the WSB rules are enforceable without a technology platform that can support automation of this enforcement. WSB will be back.”

Discord, a popular messaging platform for gamers, banned Wall Street Bets for “continuing to allow hateful and discriminatory content after repeated warnings.”

Lawmakers step in

Some lawmakers are calling for an investigation. The Democratic leaders of the House Financial Services Committee and the Senate Banking Committee said they would hold hearings. Rep. Alexandria Ocasio-Cortez, D-NY said in a tweet that Robinhood’s decision to limit trading was “unacceptable.” Texas Sen. Ted Cruz reposted Ocasio-Cortez’s tweet to his own page, writing “Fully agree.”

Who is Robinhood?

Robinhood is a trading platform that allows users to purchase stocks and options, they have also exploded during the pandemic (everyone is at home trading). Its mission is to democratize investing for all and the app now has more than 13 million users. The mission can seem a bit cloudy considering the gamification that Robinhood has done to their app. This includes giving free stocks when new members join, making the interface feel more like gambling, etc.

How does Robinhood make money?

Robinhood offers commission-free trades and with that still comes a cost. The popular trading app, along with the rest of the online brokerage industry, relies on payment for order flow as their profit engine. To ensure trades are commission-free, trades are sold to “market makers,” large firms such as Citadel Securities (Robinhood’s largest customer). Market makers execute those traders (sometimes at an inferior rate) and can use their privileged position to place themselves in the middle and make a profit. These market makers then pay e-brokers like Robinhood for the right to execute customer trades. The broker (Robinhood) is then paid a small fee for the shares that are routed, which can add up to millions when customers trade as actively as they have this year.

Here is the Financial Times explaining how it works:

“Citadel Securities pays tens of millions of dollars for this order flow but makes money by automatically taking the other side of the order, then returning to the market to flip the trade. It pockets the difference between the price to buy and sell, known as the spread.

Easy access to the market against the backdrop of wild swings in prices has led to higher trading volumes for stocks and options this year—increasing the raw material Citadel uses to turn a profit. At the same time, the rise in volatility has forced spreads wider, increasing the potential income for market makers.”

Note: Market makers like Citadel are supposed, to be honest dealers that seek the best price for orders. In 2017, the SEC fined Citadel $22 million because its algorithms were screwing the retail investors whose order flows it was purchasing.

To summarize this, Robinhood makes money by selling users’ trades to other large firms before they’re actually executed. Those firms (i.e., Citadel) make money by effectively seeing what the retail investors on Robinhood are going to do before they actually do it and act accordingly. To sum it up, these institutions are basically buying information that then informs their own trades. This is ironic as Robinhood has spent a great deal of energy marketing itself as democratizing trading, when in reality, the trading platform helps preserve the status quo, by turning its customers (their customers’ orders) into products.

Robinhood gets more capital but why?

Bloomberg reported that Robinhood had drawn from lines of credit, tapping at least several hundred million dollars. This is a significant amount of money for a firm that was valued at about $12 billion a few months ago. This also isn’t the first time the company has leaned on its credit with banks to weather turmoil. In March, the firm drew down an entire $200 million from a trio of lenders. The trading app has also seen numerous crashes, where traders haven’t been able to invest. The behind-the-scenes rush to bolster Robinhood’s finances adds to signs that recent market havoc is putting a strain on the company, which has signed up throngs of retail investors for its app during the pandemic.

In a blog post on Thursday, Robinhood said, “as a brokerage firm, we have many financial requirements, including SEC net capital obligations and clearinghouse deposits. Some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment.” According to the Depository Trust & Clearing Corp, the extreme volatility “generated substantial risk” for brokerages, resulting in the need for stricter requirements on those firms. “When volatility increases, portfolio margin requirements increase too,” Depository Trust & Clearing Corp emailed in a statement.

To break the above information down for you, let’s run through the process of how purchasing a stock on Robinhood works.

Bob decides to purchase $100 in GameStop stock on Robinhood. The trade went through right away, and Bob now sees $100 of GameStop stock in his portfolio. On the back end, Bob’s trade actually goes to a clearing house that settles the trade within 2 days. Even though Bob sees GameStop shares in his portfolio on the Robinhood app, he doesn’t have them yet (because it must go through the clearing house). In this particular case, because GameStop stock had increased by 1000% in a short amount of time, this made the market very volatile and many investors were buying and selling. There wasn’t enough GameStop stock for everyone to buy and Robinhood couldn’t allow investors to buy stock, especially if they bought using margin (when an investor borrows money from a broker to purchase stock) because Robinhood could be out of money if a trader disappeared and couldn’t cover their margin.

So why did Robinhood halt trading on GameStop and other companies?

Due to the volatility in the market, Robinhood wasn’t able to guarantee that GameStop stock (and many others) would be available when investors bought them and they didn’t want to be on the hook for the next 2 days if they couldn’t provide investors with the stock that they bought at the price they paid. The Depository Trust & Clearing Corp. told clearing houses that they would need 100% collateral on hand in order to cover the price of the stock being bought but clearing houses didn’t have enough reserves at a moments notice, and brokers (Robinhood) didn’t want to be on the hook for delivering shares that might not exist. This leads Robinhood to the only option, halt trading. During this time 13 companies (including GameStop) were unable to be purchased (although if investors owned them, they could sell) but the other thousands of stocks on the trading platform were available to buy and sell.

In an interview with CNBC, Robinhood CEO Vlad Tenev said the following:

“Robinhood is a brokerage firm and has lots of financial requirements, including SEC net capital requirements and clearing house deposits, and that’s money we have to deposit at various clearing houses. Some of these requirements fluctuate quite a bit based on volatility in the market and a lot of concentrated activity in these names that have been going viral on social media. We really are in unprecedented times and in order to protect the firm and protect our customers, we had to limit buying in these stocks.”

Given the restrictions on trading certain companies, it seems that Robinhood would have a liquidity crisis, although Tenev just said otherwise (above). This still seems a bit fishy considering Robinhood’s connection with Citadel, but we’ll touch on this in the Our Take section.

Our Take

Robinhood

Robinhood is supposed to be a platform where retail traders can invest and make money. The move that they made this past Thursday to halt trading on certain stocks, showed that, when the big guys (hedge funds) start to lose money, brokers shut the game off for the little guys so the big guys can start winning again. Their main mission is the democratization of trading and it seems as though they have done the opposite of this.

As mentioned before, Citadel has a relationship with Robinhood, they’re actually one of the main investors of Robinhood and have a position in GameStop. They also bailed out Melvin Capital for $2 billion, which makes it seem that there’s a deeper story to the trading halt that occurred on Thursday. If anyone wanted to control a listing (i.e., GameStop) and shut it down, it would be a stock exchange, like the NYSE (New York stock exchange). The NYSE would do this if they believed that there was fraud involved in the trading of stock, or if they think that there needs to be a material disclosure by the company. Actions taken by the NYSE are to protect the investor. In Robinhood’s case, they shut their own trading down, not NYSE. Robinhood didn’t know if GameStop or any other company had material disclosures that needed to be made if they were involved in fraud, and from our point of view, they weren’t trying to protect investors.

To play devil’s advocate here, the contracts Robinhood has with their users in their terms of service and in their back-end (which clears and settles trading) allow for changes depending on the situation. Remember that if an investor is buying stock on margin (their borrowing from a broker), it can be risky and if the investor can’t meet those margin requirements and disappears, Robinhood gets left with the bag. Given GameStop’s rise (along with other companies), the old margin requirements weren’t good enough and it may have exposed Robinhood to significant risk if the customers disappear because Robinhood’s portion would be underwater. It’s a risk management issue and there’s the issue for the clearing houses because they also don’t want the risks being passed through them.

Although the above sounds like a reasonable case, Robinhood allowed investors to sell the restricted stocks but not buy them. The reason why this is so troubling is that investors were making money buying these restricted stocks because they were against the short sellers (the big guys, financial institutions on Wall Street). By enabling these investors to sell but not buy, it sounds like Robinhood was allowing the hedge funds to straighten themselves out.

As of right now, we believe that Robinhood was trying to cover their own rear end by halting trades and by doing so, they screwed over retail investors and helped the big guys (hedge funds).

In a statement, the SEC vowed to protect individual, retail traders and also promised to scrutinize actions taken by brokerages that may “disadvantage investors or otherwise unduly inhibit their ability to trade certain securities.”

“We will act to protect retail investors when the facts demonstrate abusive or manipulative trading activity that is prohibited by the federal securities laws,” the SEC said in a release.

All of this is a sticky situation but we’re glad that the SEC is finally looking into this issue…..and putting retail investors first.

Signing off,

RIS